How Pacific Prime can Save You Time, Stress, and Money.

How Pacific Prime can Save You Time, Stress, and Money.

Blog Article

Facts About Pacific Prime Revealed

Table of ContentsSome Known Factual Statements About Pacific Prime All about Pacific PrimePacific Prime Things To Know Before You Get ThisMore About Pacific PrimePacific Prime - The Facts

Insurance coverage is a contract, stood for by a plan, in which an insurance policy holder obtains financial protection or repayment versus losses from an insurance business. Most individuals have some insurance policy: for their automobile, their house, their healthcare, or their life.Insurance policy additionally helps cover expenses connected with obligation (legal obligation) for damage or injury caused to a 3rd event. Insurance policy is a contract (plan) in which an insurance provider indemnifies another versus losses from details contingencies or hazards.

Investopedia/ Daniel Fishel Lots of insurance coverage policy types are readily available, and basically any private or company can find an insurer going to guarantee themfor a rate. Common personal insurance coverage types are car, health, property owners, and life insurance coverage. Many people in the USA have at the very least one of these types of insurance policy, and car insurance is required by state regulation.

How Pacific Prime can Save You Time, Stress, and Money.

Locating the price that is right for you requires some research. The policy limitation is the optimum amount an insurer will pay for a protected loss under a policy. Maximums might be set per period (e.g., yearly or plan term), per loss or injury, or over the life of the plan, additionally referred to as the life time maximum.

There are several different kinds of insurance. Health insurance assists covers routine and emergency clinical care expenses, frequently with the alternative to include vision and dental services independently.

Several preventative solutions might be covered for complimentary before these are met. Wellness insurance may be purchased from an insurance provider, an insurance coverage representative, the federal Medical insurance Marketplace, offered by an employer, or government Medicare and Medicaid insurance coverage. The federal government no more requires Americans to have medical insurance, yet in some states, such as The golden state, you might pay a tax charge if you do not have insurance coverage.

Some Known Factual Statements About Pacific Prime

The business after that pays all or many of the protected expenses linked with a car crash or various other car damage. If you have a rented lorry or borrowed money to buy a vehicle, your lending institution or renting dealer will likely need you to carry car insurance.

A life insurance policy policy guarantees that the insurance provider pays a sum of cash to your recipients (such as a partner or kids) if you pass away. In exchange, you pay costs throughout your lifetime. There are two main kinds of life insurance coverage. Term life insurance policy covers you for a specific period, such as 10 to twenty years.

Irreversible life article source insurance policy covers your entire life as long as you proceed paying the costs. Travel insurance covers the expenses and losses related to traveling, consisting of trip cancellations or delays, protection for emergency healthcare, injuries and evacuations, harmed luggage, rental autos, and rental homes. However, even several of the ideal traveling insurance provider - https://pacificpr1me.carrd.co/ do not cover terminations or hold-ups because of weather, terrorism, or a pandemic. Insurance coverage is a way to manage your economic risks. When you buy insurance policy, you buy protection versus unexpected financial losses. The insurer pays you or someone you pick if something negative takes place. If you have no insurance coverage and a mishap occurs, you might be responsible for all associated prices.

Pacific Prime Can Be Fun For Everyone

Although there are lots of insurance coverage plan types, several of one of the most usual are life, wellness, property owners, and automobile. The ideal kind of insurance for you will certainly depend upon your goals and financial situation.

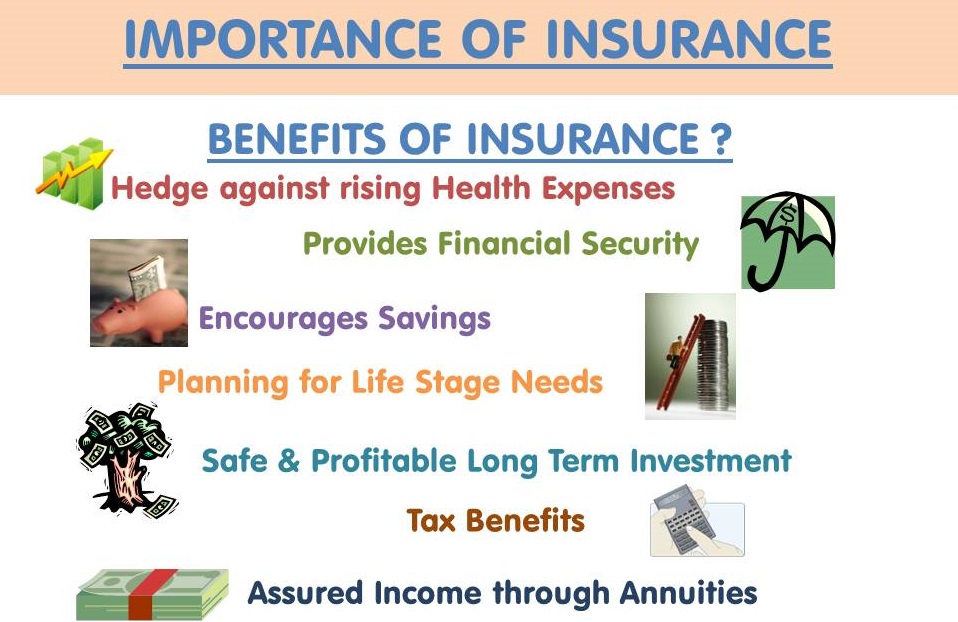

Have you ever before had a moment while considering your insurance plan or looking for insurance policy when you've believed, "What is insurance policy? And do I really require it?" You're not the only one. Insurance can be a strange and perplexing thing. Exactly how does insurance policy work? What are the advantages of insurance coverage? And just how do you locate the ideal insurance policy for you? These prevail inquiries, and luckily, there are some easy-to-understand solutions for them.

No one desires something bad to occur to them. Enduring a loss without insurance can place you in a hard economic situation. Insurance is a vital economic tool. It can assist you live life with less fears recognizing you'll get monetary help after a catastrophe or mishap, aiding you recoup much faster.

Little Known Questions About Pacific Prime.

And in many cases, like automobile insurance and employees' settlement, you might be needed by law to have insurance in order to safeguard others - global health insurance. Find out about ourInsurance choices Insurance is essentially a big rainy day fund shared by many individuals (called insurance policy holders) and handled by an insurance provider. The insurance provider uses money accumulated (called premium) from its insurance policy holders and other investments to spend for its operations and to accomplish its assurance to policyholders when they submit a case

Report this page